Population Movement Driving Property Growth in Regional Cities

Melbourne’s nation-leading population boom has been a popular property and economic narrative over the past five years, with an explosion of key sectors such as tertiary education driving migration and a global push towards the service-sector economy.

This is creating new employment opportunities that enhance population mobility. As new economic challenges such as growing housing unaffordability create new drivers of movement amongst Melbourne’s workers and residents, Victoria’s regional cities are playing an increasingly important role in supporting new population growth, property movement and economic growth.

Melbourne’s population has charged ahead growing at 2.2% per year over the past decade, but alongside this massive metropolitan population boom have been under-stated and under-examined growth in Victoria’s three largest regional cities.

The Untold Story: Rise of the Regional Cities

Behind the Melbourne-centric economic narrative, Victoria’s three largest regional cities – namely Geelong, Ballarat and Bendigo – have achieved growth rates above or equal to Sydney over the past decade. Ballarat’s population growth during the decade from 2006-2016 averaged 1.8% per year, while Geelong and Bendigo both matched Sydney at 1.7% per year. Cumulatively, the three regional cities contributed population growth of 71,074 residents during the past decade – equivalent to 6.4% of Victoria’s entire population growth – but accounted for 46.3% of Victoria’s entire regional population growth (excluding Metropolitan Melbourne). This indicates that the largest share and volume of new residents to Victoria are continuing to locate in metropolitan Melbourne, but also indicates that these three key regional cities are continuing to develop as regional hubs for growth and present opportunities for savvy property players to capitalise on an under-analysed, under-speculated residential property market.

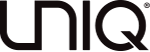

State Government population projections (Victoria In Future 2016, DELWP) indicate that during the 40 years between 2011 and 2051, Regional Victoria (excluding Greater Melbourne) will continue to grow by approximately 700,000 new residents. The same forecasts suggest that Geelong, Ballarat and Bendigo will account for 44% of future regional growth, equivalent to approximately 308,000 new residents and creating demand for 118,000 new dwellings.

This is notable for two key reasons:

- Regional Cities growth exceeding forecast ratesOfficial forecasts assume both lower growth rates (1.3% average annual population growth compared to 1.7-1.8% recorded historically) and a lower market share of 44% compared to the actual historic market share of 46%. This suggests that actual growth in Geelong, Ballarat and Bendigo is currently on-track to exceed population forecasts – producing higher demand for residential property, a need to create above-expected new residential supply and underlying precursor conditions for residential property value uplift.

- Government Infrastructure agenda & spending creating growth driversInfrastructure Australia recently published a ‘wish list’ of over $55 billion in nationally-significant infrastructure projects, including Regional Rail Link enhancements between Geelong, Ballarat, Bendigo and Melbourne. State Government infrastructure priorities have focused on enhancing connections between Geelong, Ballarat and Melbourne in particular – enhancing the viability of commuting to work in Melbourne from major regional centers. The travel time by rail from Ballarat to Melbourne is already generally comparable to travel between Pakenham or Officer to the Melbourne CBD – so the market for residential property in regional cities is expected to increasingly grow and diversify beyond traditional rural markets and incorporate younger, professional buyers seeking value for money, larger lot sizes, rural lifestyles and a point-of-difference with established Melbourne metro greenfield markets.

So what does this mean for regional city property markets?

Where population growth occurs, residential property demand follows – and it is anticipated that while smaller rural townships may experience a degree of population and jobs decline, regional cities will continue to emerge as clusters and hubs of activity and progressively achieve increased size, scale, investment and growth.

Property Growth in the Regional Cities

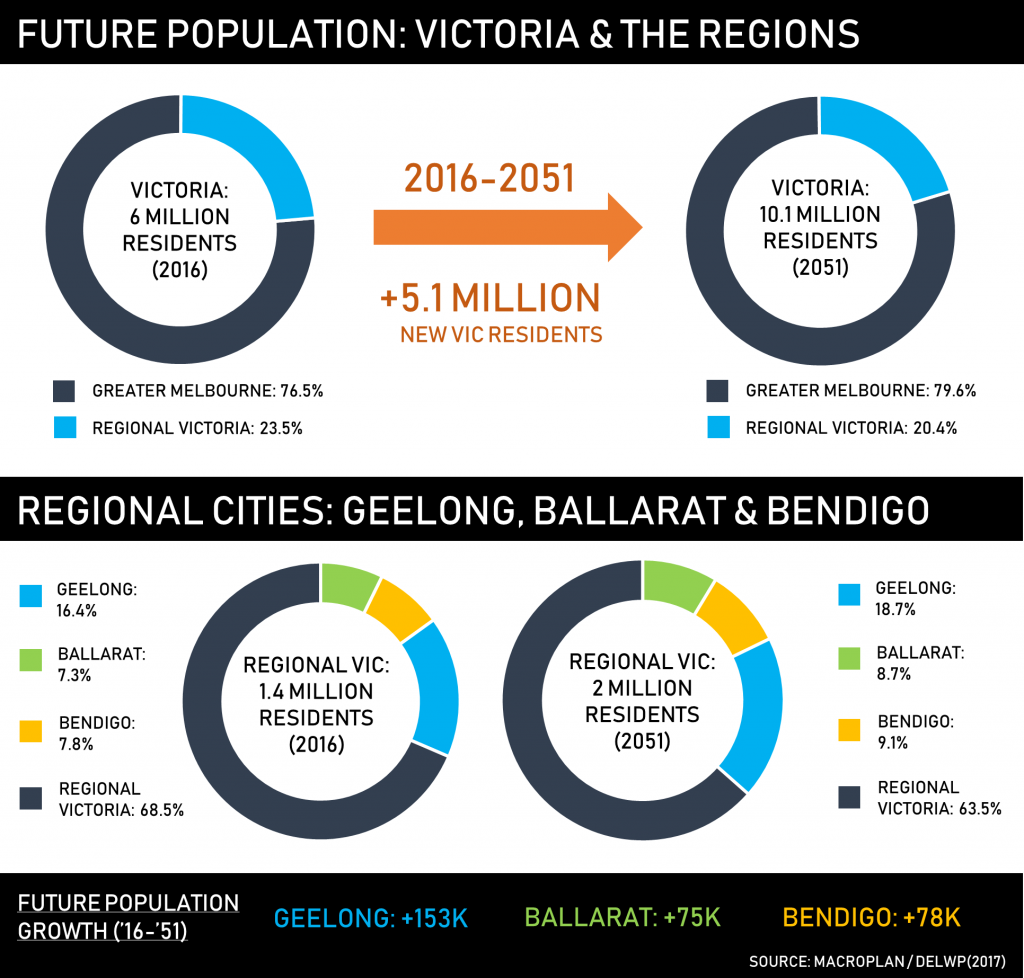

From a property perspective, house prices have already demonstrated a fairly long and stable period of upward growth that hasn’t reached the lofty heights of Melbourne’s market but demonstrates a stable, investor-friendly market that remains affordable in comparison to Melbourne. For the cash-out market (empty-nesters & downsizers) and the price-sensitive (young families and first-home buyers), the regional city markets with access to Melbourne via road and rail offer a highly competitive housing market entry point.

The 2017 median price for Ballarat and Bendigo was $320,000 and $325,000 respectively, while Geelong was more comparable with Melbourne metro greenfield fronts (such as Wyndham and Melton) at approximately $450,000. Over the past decade, the median house price in Ballarat and Bendigo increased by $120,000 or approximately 4.9% average annual growth per year. Geelong sat slightly above with a 10-year value uplift of $173,000 and grew more quickly at 5.5% average annual growth per year. Given strong forecasts for regional population growth and a need to create new residential lots and dwellings to facilitate this growth, there are strong opportunities for both property buyers and property proponents to engage in regional markets and diversify out of highly congested, fluctuating Melbourne markets.

DID YOU KNOW

A key driver of migration is access to employment. Unemployment rates in Ballarat (4.2%), Bendigo (7.1%) and Geelong (6.4%) were all below the 9% unemployment rate recorded in the Western Melbourne region including Wyndham and Melton in 2018.

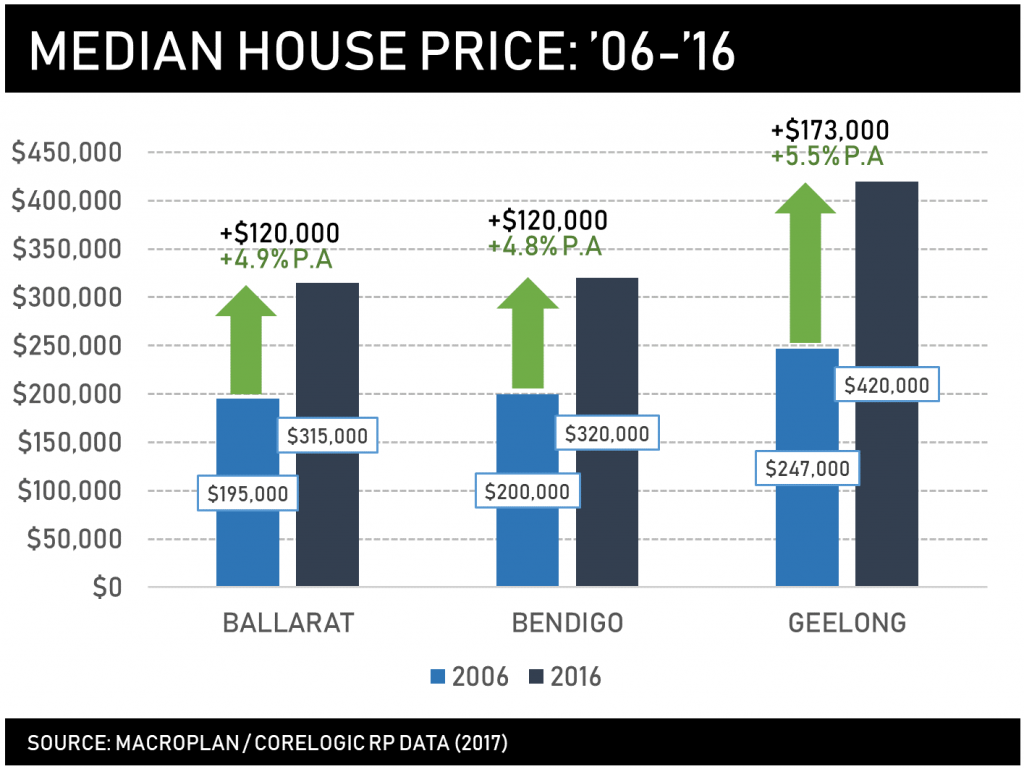

Melbourne Migration: Buyers Transitioning from Metro to Regions

Analysis of migration data from the 2011 and 2016 Census paints a picture of Melbourne’s inter-relationship with growth in regional cities. Residents transitioning from Melbourne to a regional city accounted for roughly 9.1% of total net migration to Geelong, Ballarat and Bendigo – but in real terms, outward migration from Melbourne equated to over 20,737 residents moving into a regional city. Based on average household sizes (2.6 people per dwelling for Victoria), this equates to mobility amongst just under 8,000 households or dwellings – and indicates the volume of potential residential property action associated with this small but growing buyer cohort.

Melbourne’s significance as a stepping-stone for regional migration can be summarised via the proportion of total net migration for each regional city relative to the number of new residents that moved from a Melbourne metro municipality. The standout city was Geelong, in which 28.6% of total net migration originated from Melbourne – indicating that over 1-in-4 new residents came from Melbourne. Ballarat and Bendigo had lower shares of 14.4% and 13.1% respectively – but are expected to follow a similar trajectory to Geelong as residential capacity in Melbourne’s greenfield areas and affordability issues continue to prompt population mobility.

As a result, Bendigo, Ballarat and Geelong are well positioned to continue to grow and create ongoing and sustained residential property demand – and we also note that to a large extent, land within Melbourne’s Urban Growth Boundary has been land-banked by major developers, resulting in supply constraints and a lack of opportunities for developers who may have missed the boat. There are opportunities within the regional cities to access larger, cheaper residential development sites – but from MacroPlan’s internal project experience, developer interest in site selection and opportunity analysis undertaken for major regional centres with rail and highway access to Melbourne is continuing to grow. There is a window of opportunity to capitalise on Victoria’s long-term positive economic trajectory, but the boat isn’t waiting for stragglers.