A first-time buyer’s checklist, including the first-home owner’s grant, what lending institutions require from buyers, pre-approval, budgeting and advice for saving.

Getting into the market by securing your first home can be a thrilling, roller coaster of a ride, there is so much to look forward to, but so much to consider and organise.

The first thing you need to do is make sure you have someone in your finance corner to guide you through this exciting but daunting experience of arranging your first home loan. A quality experienced Mortgage Broker working closely with you to determine exactly how much you will need saved, when you need it by and what loan features will suit your first-home purchase. Having a good Mortgage Broker will make sure you get what you want and need in a loan, ensuring you don’t end up with something you didn’t want or paying extra for features you will never use.

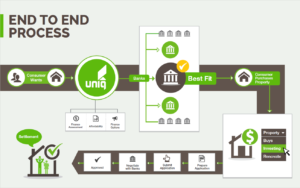

At UNIQ Finance we have drawn on the combined experience of all our team to determine what works best (and what to avoid) to develop a process to ensure we always source the best solution for your individual requirements & this is never more important than the time when you are looking to purchase your first home and take out your first Home Loan.

At UNIQ Finance we have drawn on the combined experience of all our team to determine what works best (and what to avoid) to develop a process to ensure we always source the best solution for your individual requirements & this is never more important than the time when you are looking to purchase your first home and take out your first Home Loan.

Navigating relevant issues such as, first home owners grant, government stamp duty, genuine savings, mortgage insurance, repayments, loan serviceability & obtaining a pre-approval so you can confidently go shopping or to auction on the weekend are all important things that a First Home Buyer needs to understand, following a quick summary of a number of these;

- First Home Owners Grant – Is a national scheme that is administered and funded by the relevant state, so what you get really depends on where you are in Australia. Typically it involves a one-off grant.

- Gov. Stamp Duty – This is the revenue levied by states for the ownership transfer of land & its capital improved Value & is calculated based on the value of the property. It is paid by the purchaser and is payable to the relevant State revenue office

- Genuine Savings – A term used by the Banks when working out if the funds you have put together for the deposit have genuinely been saved by the proposed borrower over a period of time showing capacity to meet the loan repayments

- Mortgage Insurance – This is an insurance policy where the borrower pays a once off premium, the policy is to compensate the lender in the event of default on the mortgage

- Loan Serviceability – This is the method a lender uses to determine if the borrower has the ability to service or meet the loan repayments calculated by the income & expenses they will have at the time of the loan being taken out

- Pre-Approval – This is where you make an application to a lender and they make an evaluation on whether the borrower qualifies for a loan, subject to satisfactory property and valuation. This doesn’t constitute a formal loan offer but gives some confidence to the potential borrower when they are out in the market looking at property

As highlighted above you can quickly see that there is a lot to take in and at UNIQ Finance our focus is on providing a service that has an eye for detail to help our clients reach their financial goals. For us to do this we follow a simple process as explained in the picture below.

In summary please remember the following

- Do your research

- Align yourself with an experience Mortgage Broking company

- Remember that no 2 mortgage brokers are created equal

Written by UNIQ Finance Group General Manager, Bryce Deledio